flow through entity example

Example - How to use. For example a flow-through entity that elects into tax year 2021 on March 31 2022 pays all tax due for the year on that date.

Pass Through Taxation What Small Business Owners Need To Know

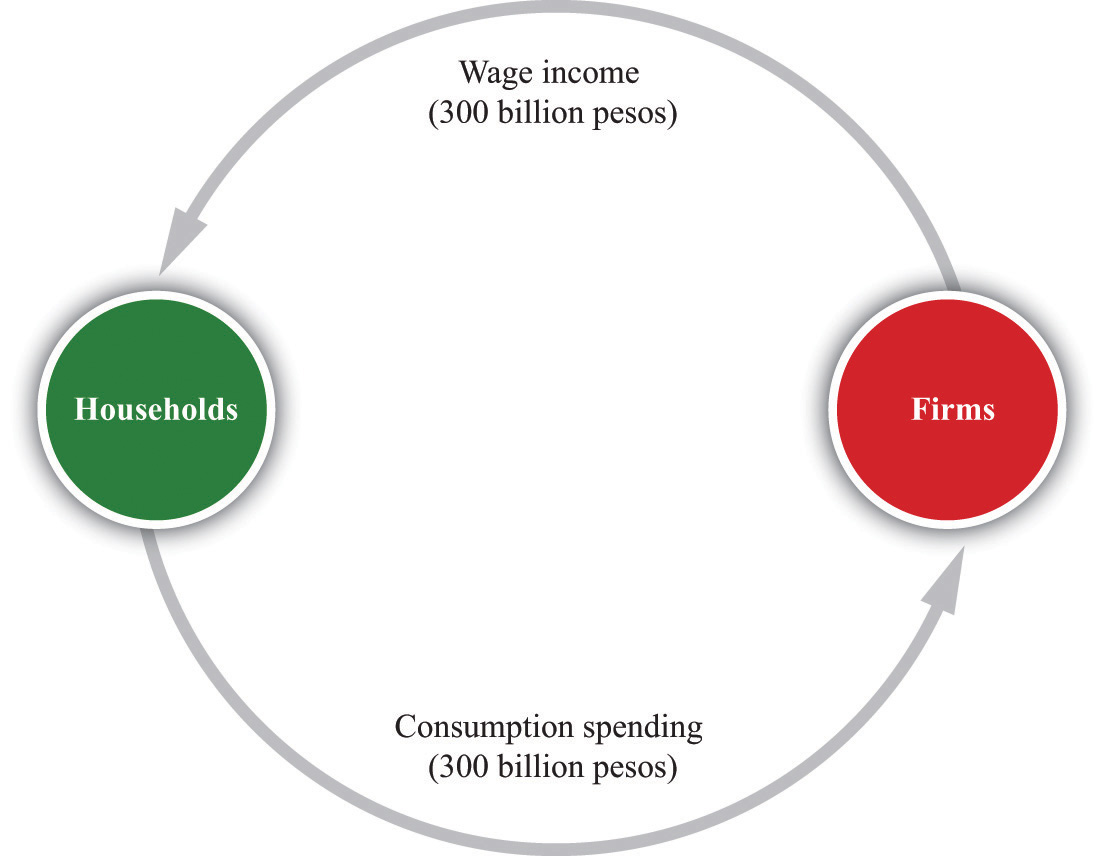

A flow-through entity is a legal entity where income flows through to investors or owners.

. Chantelle Larry and Ryan are shareholders in the Triple Lucky S corporation. A flow-through entity is a legal business entity that passes any income it makes straight to its owners shareholders or investors. A flow-through entity is a legal business entity that passes income on to the owners andor investors of the business.

A hybrid entity for this purpose is an entity that two contracting States that are parties to a bilateral tax treaty characterize differently eg. Chantelle is a 20 shareholder. Examples of flow-through or pass-through entities are S corporations limited liability companies LLCs partnerships and sole proprietorships.

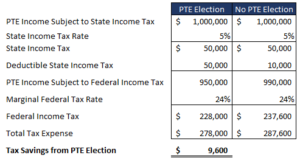

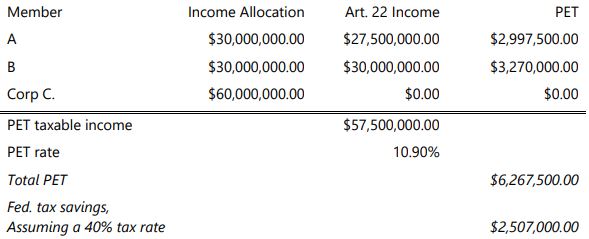

PASS-THROUGH ENTITY TAX. Flow Through Entity means an entity that a for Federal income tax purposes constitutes i an S corporation as defined in Section 1361a of the Code ii a qualified subchapter S. The following types of common flow.

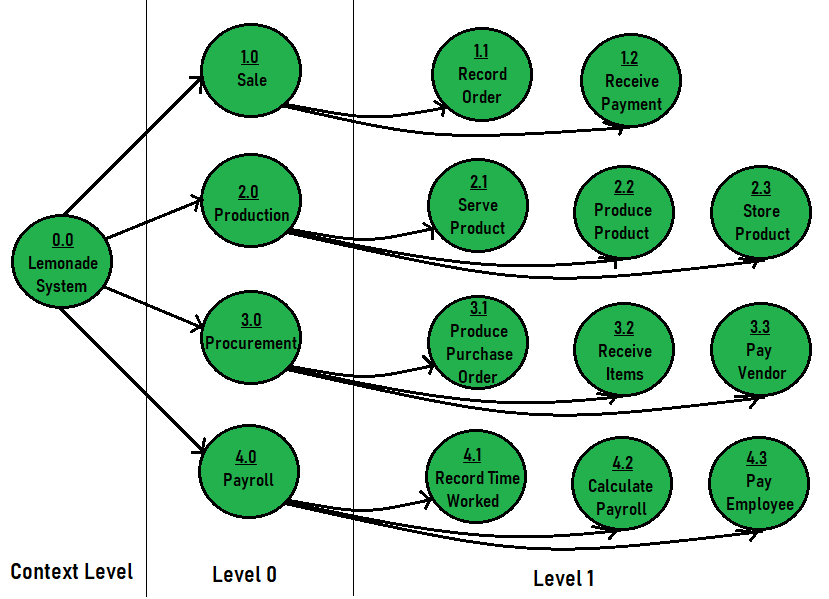

For example- new_account_target to new_account_targetset. An entity such as a limited liability company. Although this flow-through entitys members may report their.

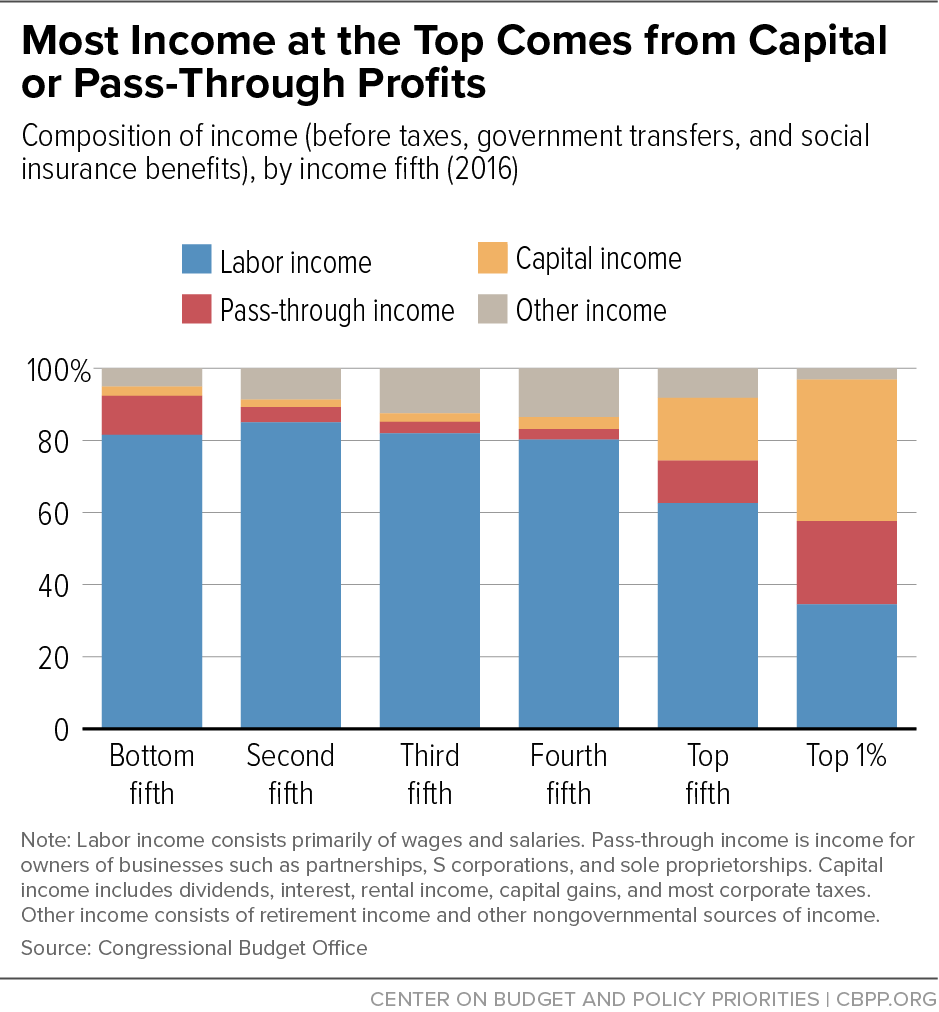

Businesses were organized as flow-through entities in 2012up from 49 percent in 1985 figure 1. Larry a 50 shareholder. 3 Go to your custom flow paste Relationship Entity Name in the entity.

That is the income of the entity is treated as the income of the investors or owners. A flow-through entity is a. For example take a US LLC that is treated as transparent in the US but assume it is tax resident in the UK.

Examples of flow-through or pass-through entities are S corporations limited liability companies LLCs partnerships and sole proprietorships. Consequently what is a flow through entity for tax purposes. The UK treats the US LLC as an opaque entity and would subject it to corporation tax.

During that same period the share of business receipts going to flow-through entities. If youre exploring different ways to structure your business you may have come across something called a flow-through or pass-through entity. For example some of you may have profitable flow-through entities that generate taxable income but historically you pay very little Michigan income tax due to PA-116 credits.

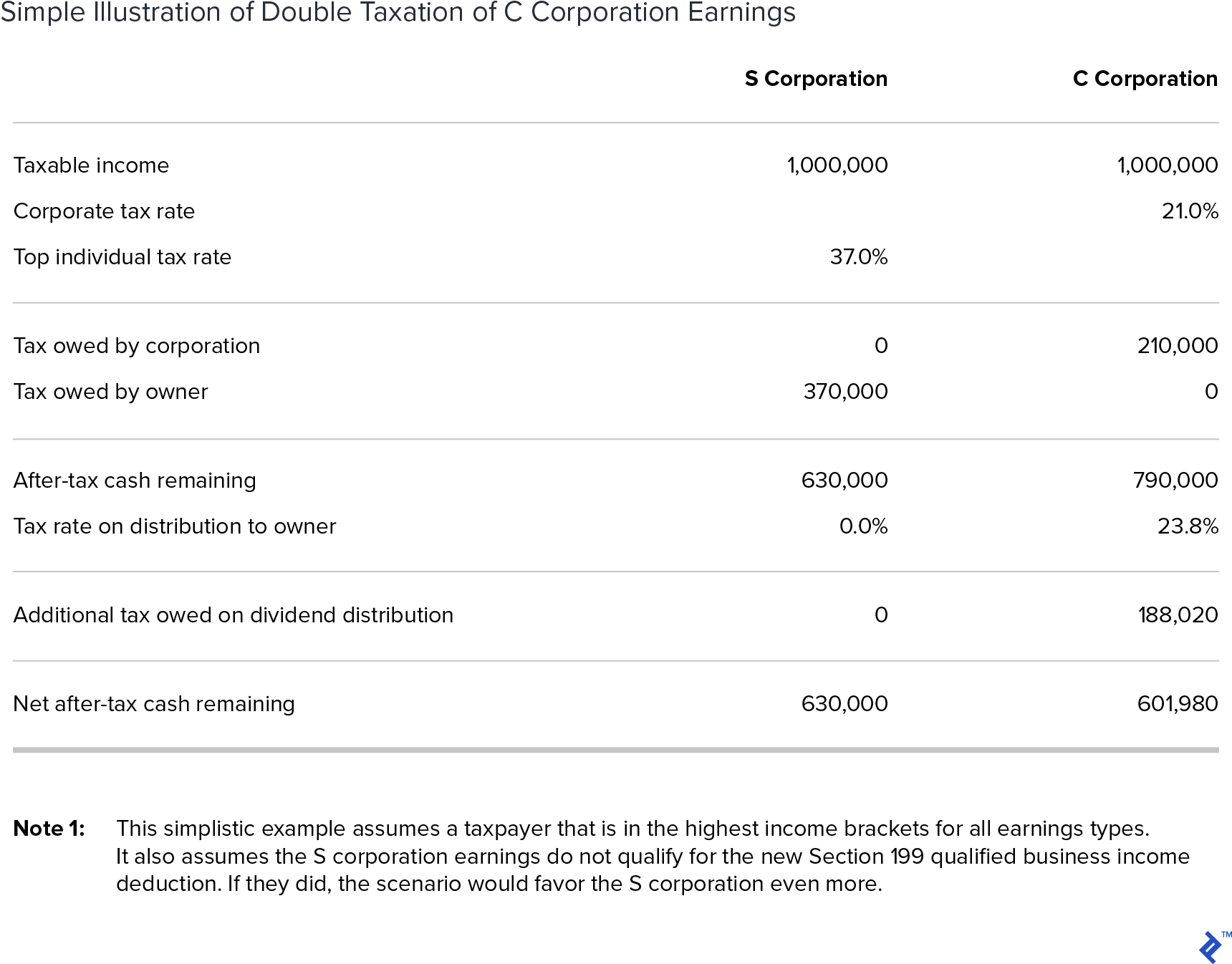

A flow-through entity also known as a pass-through entity or fiscally-transparent entity is a legal business entity where its profits flow directly to the investorsowners and only the investors or owners are taxed on the income. Partnerships file an entity -level tax. The Termbase team is compiling practical examples in using.

Flow-Through Entity is an example of a term used in the field of economics Taxes - Income Tax. Subsequently just these individuals and not the entity.

Sole Proprietorships And Flow Through Entities Ppt Download

What Is A Pass Through Entity Definition Meaning Example

9 Facts About Pass Through Businesses

Pass Through Entity Level Tax Is This A Viable Salt Cap Workaround Blue Co Llc

What Are The Types Of Business Entities Legal Entity Management Articles

Understanding Flow Through Entities Like S Corporations And Llc S Pace Accounting

Difference Between Dfd And Erd Geeksforgeeks

It S Personal Planning For New York S Pass Through Entity Tax Lexology

Business In The United States Who Owns It And How Much Tax Do They Pay Tax Policy And The Economy Vol 30 No 1

Pass Through Entity Definition Meaning Investinganswers

Pass Through Entity Taxes And Business Types Explained

10 Tax Benefits Of C Corporations Guidant

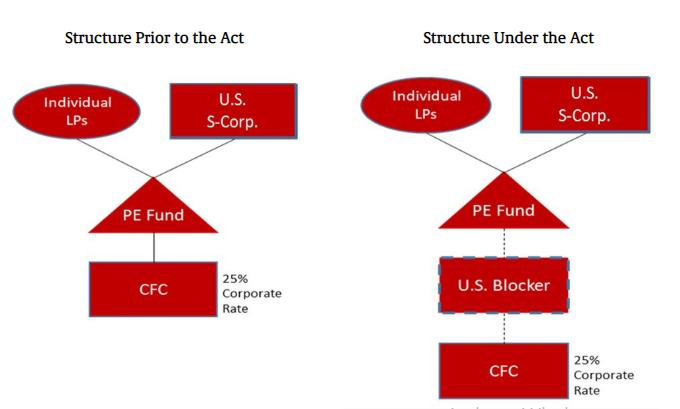

New Proposed Regulations Would Ease Gilti Tax Burden On Non Corporate Taxpayers Lexology

Why The Focus On Ebitda Chris Mercer

C Corp Vs S Corp Partnership Proprietorship And Llc Toptal

Qbi Deduction Frequently Asked Questions K1 Qbi Schedulec Schedulee Schedulef W2

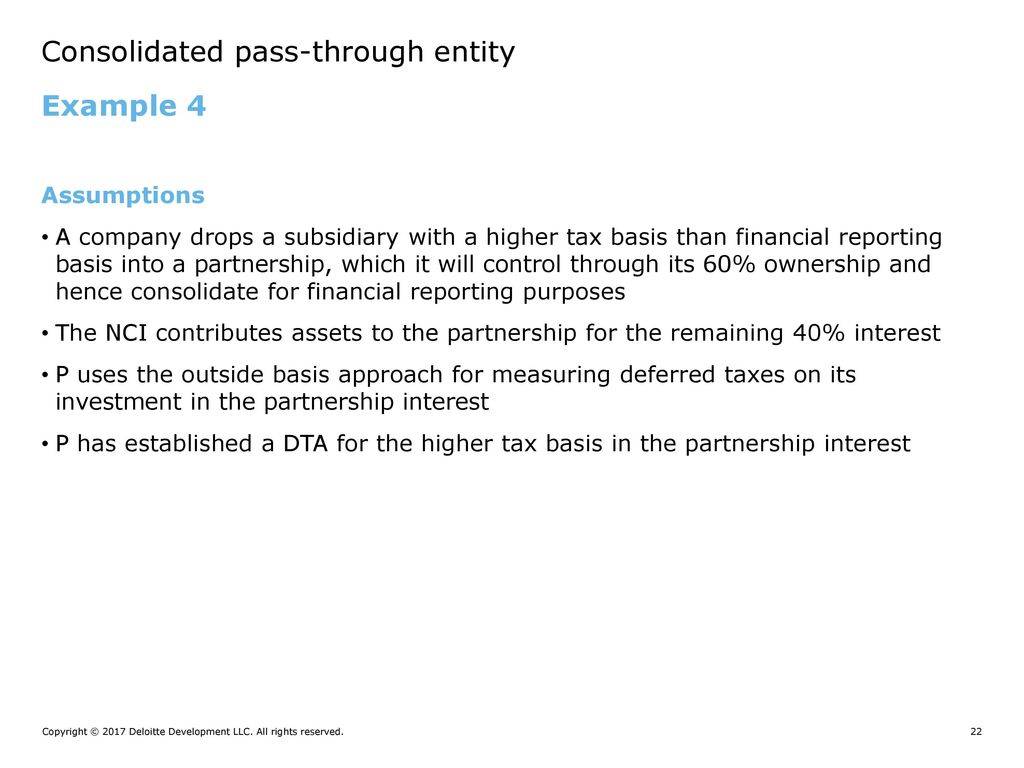

Accounting For Investments In Pass Through Entities Ppt Download